Intro

Have you experienced long hold times and being passed around when dealing with the bank? Everyone’s the same, and people are running out of patience.

But what if it can change?

With CIM in financial institutions, customers can experience faster, smoother, and more personal transactions—and Q-nomy’s solutions can help.

Ready to transform your banking? Let’s explore how CIM leads the way.

Understanding Customer Interaction Management in Financial Services

Ever wished dealing with your bank was as easy as chatting with a friend? That’s what CIM in financial institutions does—making every interaction feel smoother and less stressful regardless of the manner.

But why is it important?

Remember, trust is crucial in handling money—that’s what banks are for. CIMs like Q-nomy help deliver safe and secure services by:

- Creating a consistent and reliable experience.

- Ensuring interactions are secure and trustworthy.

With CIMs, you can build customer trust while making their banking easier.

Improving Customer Experience with CIM in Financial Institutions

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

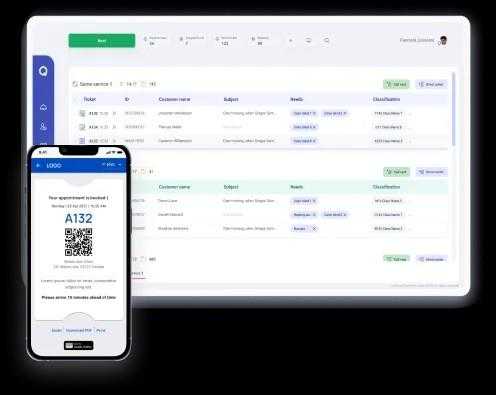

(Image: Qnomy.com)

Have you ever felt that your bank understands you? It’s incredible, right? It’s all thanks to CIMs like Q-nomy—and here’s how it makes customers’ lives easier.

1. Personalized services

CIMs make every service feel like it’s made just for you, thanks to their ability to remember your needs and past interactions.

2. Fast solutions

Long wait times? Say no more—CIM connects you to the right person faster, reducing hold time and avoiding frustration.

3. Seamless experiences

Start online, finish in person—CIM keeps everything connected, so you don’t need to repeat yourself.

In short, CIM software like Q-nomy makes banking feel effortless and more personal.

Ensuring Regulatory Compliance and Data Security

Are you worried about your money's safety? Customer interaction management systems provide banks with an extra layer of security.

Here’s how they keep your info safe and compliant with regulations.

- It tracks everything. From money transfers to online payments, CIMs save your interactions securely.

- They’re data guards. Afraid of data breaches? CIM systems like Q-nomy keep your information locked tight—away from malicious hands.

- Monitors in real-time. Whether it’s new regulations or amendments, CIMs ensure everything follows the rules.

Q-nomy’s CIM for financial institutions guards your money and data—giving you peace of mind with every transaction.

Streamlining Operations and Reducing Costs

Wondering how banks speed things up and save money? That’s where customer interaction management with Q-nomy falls into place—simplifying processes and cutting costs.

Automates the boring stuff

Tired of answering the same questions? Q-nomy’s customer interaction management system handles basic tasks automatically—whether it’s reminders of FAQs—so your staff can focus on real problems.

One-stop system

Went to a bank only to find out your details are in another branch. It feels frustrating, right?

But with a CIM, you can store information in one place, saving time and resources.

Fewer mistakes, more savings

With fewer mistakes and less manual work, you can cut costs and earn more!

Q-nomy’s customer interaction management system helps you provide better services without the extra effort and headache.

Facilitating Digital Transformation in Financial Services

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

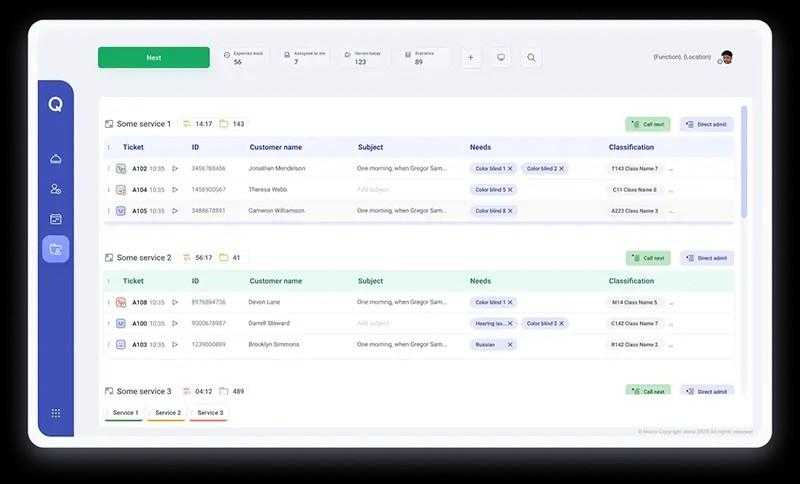

(Image: Qnomy.com)

The digital era is here, and CIM in financial institutions makes it work seamlessly. Here’s how these solutions give you a faster, more personalized experience.

- Seamless integration. From apps to branches, CIMs ensure seamless experiences, no matter how you interact.

- Smarter services. These solutions personalize banking with data, giving you what you need and when needed.

- Better digital experience. CIMs ensure you can make your digital game faster, easier, and more convenient.

Going digital doesn’t have to be complicated. With customer interaction management solutions, you can keep things running smoothly—ensuring a simpler and more personal experience.

Boosting Cross-Selling and Up-Selling Opportunities

Ever notice how your bank suggests the right products at the perfect time? That’s CIM working behind the scenes. Here’s how you can increase opportunities with CIMs.

- Personalized offers. CIMs analyze data and past interactions to know your needs—from loans to credit cards.

- Perfect timing. Your money habits predict your needs, and CIMs track your habits for when you might need something extra, whether it's another savings account or investment.

- Better engagement. These solutions make offers feel natural and helpful, not pushy—making it easier to say yes.

CIMs help banks offer the right products at the right time, making your experiences smooth and personal—a win for everyone!

In Conclusion, CIMs Are the Future of Banking

The future of banking is here—and CIMs like Q-nomy are making it happen. From improving customer experience to expanding opportunities, customer interaction management solutions transform financial institutions' operations.

Have you experienced getting customer interaction management solutions for your financial institution? Share your experiences and thoughts below, and let’s look forward to the future of banking together!