Intro

What if it was possible to predict financial trends by examining the digital footprints left by search engine queries? This piece explores how historical SEO data can revolutionize the finance industry as a forecasting tool. We reveal how these data points correlate with market behaviors by tracking changes in search traffic, keyword relevancy, and consumer interest over time.

An Examination Of Market Trends And Historical SEO Data

It's similar to decoding signals to analyze market trends utilizing past SEO data. This information might provide hints about changing investor preferences and market dynamics. It covers keyword popularity and website traffic over time. For instance, an abrupt increase in searches for "gold prices" may indicate developing worries about the soundness of the economy.

First, consider how general economic factors are reflected in SEO statistics. During an economic boom, an increase in the number of people searching for "startup investments" may indicate investor confidence and a readiness to take risks. On the other hand, a growing number of queries for "safe investments" could indicate an impending recession. Always keep in mind that when it is about finance and investing, don’t take risks and stay educated. You can use platforms like FBC Edge which connects investors and educational institutions. Learn more now!

Examining patterns over several years is a necessary part of data analysis. Tools such as Google Trends can spot trends that match past shifts in the market by displaying the frequency of a specific phrase search. For example, before the 2008 financial crisis, there may have been an increase in searches for "mortgage risks," which could have been a red flag.

Moreover, SEO data might emphasize industry-specific patterns. An increase in searches for "renewable energy stocks" may indicate a move toward environmentally friendly investments. Based on search data that reflects public interest, financial analysts can use this information to forecast which sectors would likely see growth.

Examples from real life further elucidate this notion. Before the cryptocurrency boom, searches for phrases like "crypto investing" and "Bitcoin" increased significantly. Early adopters could profit from this movement before the general financial markets caught on.

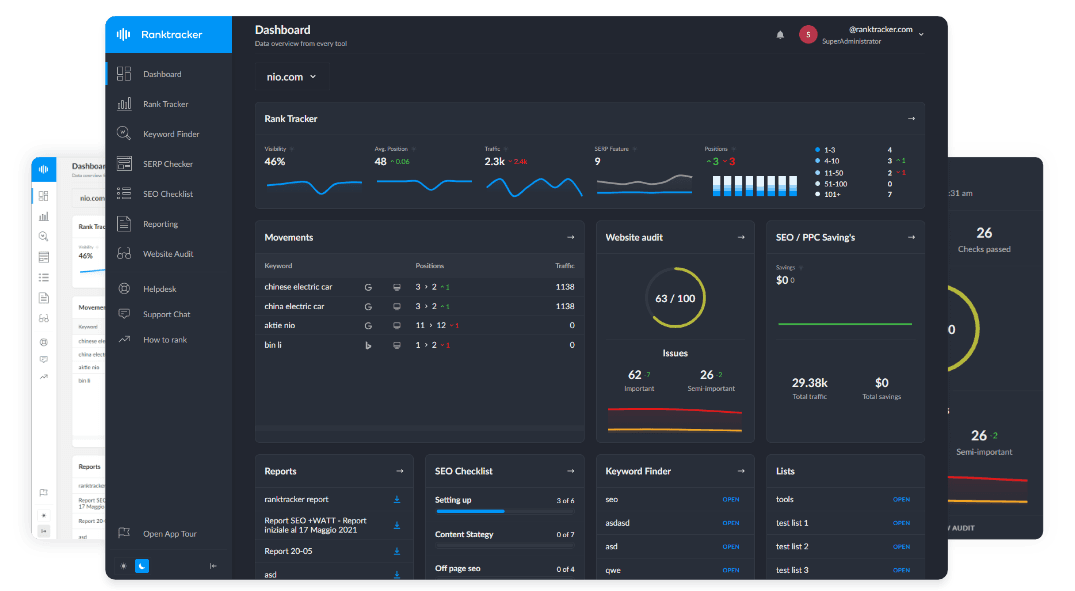

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Historical SEO data gauges market movements and investor mood. By incorporating this data into their market analysis, investors and analysts can assess public interest and possible market shifts, enabling them to make well-informed decisions that align with developing trends.

Including SEO Data in Models of Financial Forecasting

Using SEO data can significantly improve the predictive accuracy of financial forecasting models. The first step in this process is to gather SEO data, such as search volume, keyword competitiveness, and website traffic sources. These measurements highlight customer behavior and interest in financial markets or products.

The next step is to add this data to conventional financial models. For example, by tracking the rise in searches for phrases like "investment in tech startups," analysts might predict increasing rates of investment in this industry. This method uses statistical techniques and software that can handle massive datasets and integrate many data sources for thorough analysis.

For successful integration, data accuracy and relevance must be preserved. This entails routinely updating the data inputs to account for the most recent market dynamics and search trends. Furthermore, integrating SEO data with other market indicators like stock performance and economic statistics can result in a more reliable forecast model.

Results can be skewed by misinterpreting data or relying too much on erratic SEO patterns. Therefore, it is advised to combine SEO insights with well-established financial forecasting techniques to balance out any abnormalities.

Financial companies that have employed SEO trends to forecast consumer stock purchase patterns or real estate investment trends based on local search data are examples of effective integration. By using timely, SEO-driven insights about customer mood and market conditions, these firms have frequently outperformed their peers.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

In conclusion, analysts can gain a deeper understanding of consumer behavior and market dynamics by incorporating SEO data into financial forecasting models. This can help them make more informed predictions and strategic investment decisions.

Difficulties with Using Past SEO Data

Effective use of historical SEO data has its challenges. The data's consistency and correctness are among the main problems. Numerous factors, such as search engine algorithm updates and changing user behavior, can affect SEO metrics and the data's trustworthiness over time.

The interpretation of these data presents another difficulty. Long-term market patterns may not necessarily align with SEO trends, which exhibit volatility. Analysts must discern between passing trends and steadfast, enduring interest in a subject or item. This calls for a thorough comprehension of market dynamics and SEO.

Ethical and data privacy concerns are also significant. Analysts must ensure that any SEO data used conforms with all legal standards, especially when handling user data or tracking search behavior, especially in light of increasingly stringent rules such as the GDPR.

Furthermore, incorporating SEO data into conventional financial models presents technological difficulties. Analysts must possess the ability to manipulate large datasets and combine various data types into coherent models, which frequently requires continual training in addition to sophisticated analytical tools and software.

Examples from the real world include situations when businesses have over-invested in trends that were only transient because they mistook increases in search volume for genuine interest. Refining SEO data in financial forecasting requires learning from such errors.

In summary, although historical SEO data provides insightful information, successfully utilizing it necessitates overcoming major obstacles to data integration, quality, and interpretation. By tackling these issues and utilizing SEO data, financial analysts can improve market trend analysis and investment decision-making.

SEO Data's Future in Financial Markets

The application of SEO data in financial markets is set to revolutionize how analysts and investors comprehend and forecast market movements as the digital landscape develops. Due to the growing digitization of financial activity, the number of searchable online data will only increase, providing greater insights into the behaviors of investors and consumers.

Combining machine learning (ML) and artificial intelligence (AI) with SEO data will be a significant advancement in the future. These technologies may quickly analyze large amounts of SEO data and spot patterns and trends that human analysts might miss.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

AI, for instance, can forecast changes in market sentiment by tracking variations in the number of searches made for particular financial services or products. This can give investors a significant advantage when modifying their portfolios to benefit from or protect against impending developments.

A further promising development is the improvement of individualized financial guidance. Financial services can better understand the interests and habits of individual investors by utilizing SEO data and customizing their offers to fit those demands.

Envision a situation where a financial advisory platform leverages your search patterns to provide tailored investment options or informative articles to assist you in comprehending your investing environment.

Blockchain technology may also impact SEO data usage in the future by improving security and transparency. It may make it possible to build decentralized, transparent, and permanently kept databases of SEO data. This has the potential to lower fraud and boost confidence in SEO data as a trustworthy source for financial forecasts.

Conclusion

When historical SEO data is utilized, financial forecasting can benefit from a unique perspective that combines traditional research with digital insights. This connection provides a deeper grasp of industry trends and consumer sentiment and improves prediction accuracy. The strategic application of SEO insights in financial planning and investment strategy emerges as both a requirement and an advantage for forward-thinking analysts and investors as we navigate a data-driven world.