Intro

In the digital age, financial institutions must master the art of SEO while adhering to strict regulatory compliance. This delicate balance is crucial for boosting online visibility and maintaining trust. As regulations evolve, the challenge intensifies. How can banks and financial firms stay compliant and excel in SEO? This article explores practical strategies and real-world examples, providing a roadmap for achieving SEO success without crossing legal lines. Discover how harmonizing digital marketing with financial regulations can propel your online presence and credibility to new heights.

The Symbiosis of SEO Strategies and Financial Compliance Requirements

Harmonizing Digital Marketing with Legal Mandates

Financial service marketing is similar to any other industry in terms of how you deal with your campaigns in this digital age. Businesses have to be more out there digitally and be compliant simultaneously. Banks and financial-related firms are under many more regulations to protect us as customers. Adherence to the legal requirement by integrating SEO techniques into them requires a good knowledge of SEO techniques and the legal provisions.

This balance ensures that online marketing efforts are practical without risking legal penalties. By integrating compliance checks into the digital marketing process, financial companies can simultaneously achieve visibility and trustworthiness. Investor and finance enthusiasts can Visit https://immediate-edge.nl/ to learn more about regulatory compliances in finance and investing itself.

Case Studies: Successful SEO in Financially Regulated Industries

Real-world examples illustrate the successful integration of SEO and compliance. For instance, a leading bank improved its search rankings by using compliant keywords that matched user search intent without making misleading promises. Similarly, a financial advisory firm created valuable, regulation-compliant content, boosting its SEO and establishing its credibility. These case studies show that achieving high search engine rankings is possible while adhering to financial regulations, offering valuable lessons for other companies in the sector.

Critical SEO Techniques for Finance Websites

Leveraging Keywords Without Compromising Compliance

Keywords are essential for SEO but must be used carefully in the financial sector. Misleading keywords can lead to regulatory issues. Keywords should describe the services accurately — within reason. So instead of "best investment returns", compliant keywords may be "investment strategies for steady growth." This is done in a way that does not deceive users and does not bring SEO activities to the attention of regulators, where these two values - transparency through honesty and high ranks in Google - are in balance.

Quality Content for SEO and Financial Compliance

Although we have written above that SEO and regulatory compliance are two different worlds, quality content is the bridge between those two. Content should be educational, factual, and (of course) compliant with regulations for financial institutions. For transparency, this means correct disclaimers and accurate information supported by user education and first-hand data. Good content helps in better search engine ranks, and on the other hand, it also helps in building trust among the users, showcasing transparency and abiding by the rules of the game.

Ensuring Data Privacy and Security in SEO Campaigns

How Data Protection Laws Affect SEO: GDPR, CCPA, & More

Regulations like the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR) change the face of common SEO strategies. The information gathered should be under the user's permission and used in a way that will not harm the user in any other sense than the law stipulated under these guidelines.

SEO campaigns must be designed to comply with these laws, which involve transparent data collection practices and robust security measures to protect user information.

Best Practices for Secure Data Handling in Digital Marketing

To comply with data protection laws, financial companies must implement best practices for data handling. This includes using secure servers, encrypting sensitive data, and conducting regular security audits. Additionally, companies should be transparent about their data collection and usage policies, providing users with clear information and options for data control. These practices help build user trust and ensure compliance with legal requirements.

Regulatory Considerations in Content Creation and Link Building

Creating Transparent and Compliant Financial Content

Transparency is critical when creating content for financial websites. Content should be explicit, accurate, and free of misleading information. Including disclaimers and providing sources for data can help maintain transparency. For example, explaining the risks involved when discussing investment opportunities is crucial. Transparent content helps build trust and ensures compliance with financial regulations.

Ethical Link-Building Strategies within Regulatory Boundaries

Link building - is one of the most essential SEO strategies - but during 2015 and beyond, you must approach it ethically in the financial sector. They should be clean, from trusted sources, and point to similar content. Refrain from purchasing links that would ultimately drive penalties. Instead,ke the time to build links from good content and other legitimate, compliant sources and create faith in financial sites.

Regulatory Constraints vs User Experience

Making Your Website Usable and Legal

A user-friendly website helps you attract visitors and achieve SEO success. However, financial websites are also subject to regulatory needs. This means having a site that is accessible to all, user-friendly, and in compliance with any applicable legal disclaimers. For example, the tips for clear navigation menus and simple design that can direct users to the information they need without breaking any laws.

Enhancing Customer Trust through Compliance-focused UX Design

Designing a website with compliance in mind helps build customer trust. When important information, including privacy policies and disclaimers, is clearly stated and readily available, users feel more at ease. A compliance-focused UX design not only makes the website user-friendly but also guarantees that it conforms with all legal regulations, giving visitors confidence and trust.

Keeping Up with Regulatory Changes and SEO Trends

The financial regulatory environment is continuously changing. It's critical to keep up with changes to regulations and trends in SEO. Financial organizations ought to have a procedure in place to monitor rule modifications and modify their SEO tactics as necessary. Participating in professional forums and subscribing to industry newsletters can facilitate keeping up with the latest changes.

Agile SEO Practices for a Continuously Evolving Regulatory Landscape

Flexibility in SEO practices is essential for adapting to regulatory changes. This involves regularly reviewing and updating SEO strategies to ensure compliance. An agile approach allows financial institutions to respond quickly to new regulations without compromising their SEO efforts. Regular audits and updates to website content and SEO tactics can help maintain compliance and effectiveness.

Leveraging Technology for SEO and Compliance Synergy

Utilizing AI and Machine Learning in Regulatory Adherence

Advanced technologies like AI and machine learning can aid in regulatory adherence. These technologies can analyze vast amounts of data to identify compliance risks and optimize SEO strategies. For example, AI can help monitor content for compliance with regulations and suggest improvements. Leveraging these technologies ensures that SEO efforts are both practical and compliant.

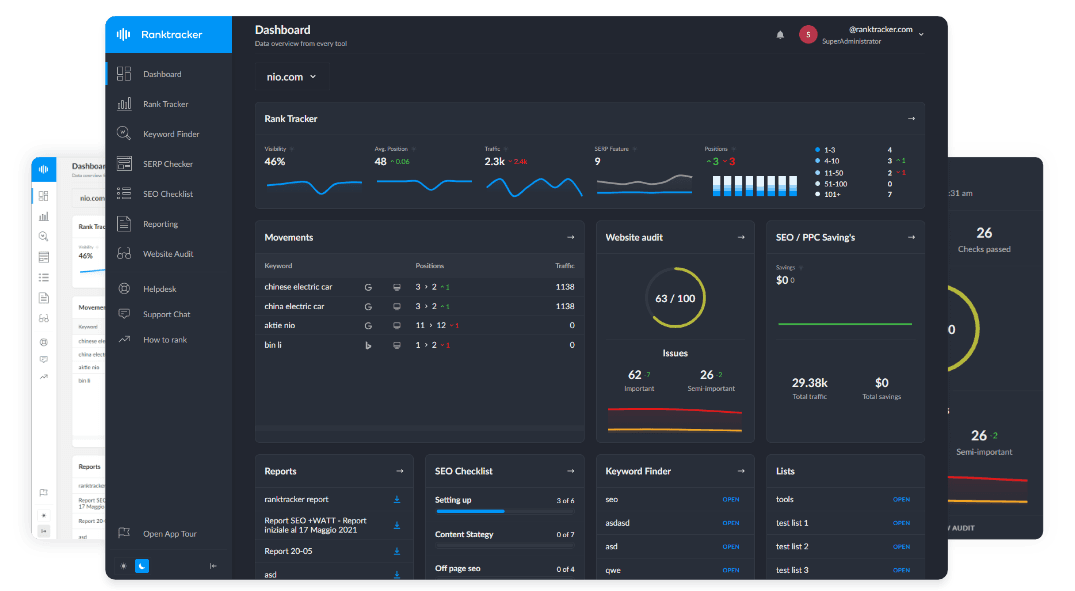

Tools and Software for Integrated SEO and Compliance Management

Various tools and software can help manage both SEO and compliance. Tools like compliance management systems and SEO analytics software can streamline the process. These tools can track regulatory changes, monitor website performance, and ensure SEO strategies align with compliance requirements. Using integrated tools helps financial institutions manage their online presence more efficiently and effectively.

Conclusion

For financial institutions to thrive online, there is a difficult balance to maintain between SEO and regulatory compliance. By using ethical SEO, financial firms may stay within the rules and increase their visibility and ranking. AI and data protection tools also enhance this balance to ensure the company does not recognize things. In conclusion, the approach to SEO and compliance is multifaceted, and when implemented effectively, not only does it increase the website's ranking, but it also builds customer trust and complies with the regulations for sustainable and effective business in the constantly changing digital environment.