Intro

If you’re a freelancer that works in digital, you’ll no doubt spend 99% of your working day consumed by the tasks related to your job. Filing a tax return or even thinking about managing your tax affairs is not something most professionals will consider on a day to day basis. That said, paying tax is a legal requirement which means everyone should stay on top of their own tax obligations, even if it's not something anyone particularly enjoys doing. Below is some handy advice to help lessen the burden when it comes to managing your tax affairs. Filing a tax return or even thinking about deductions, child tax credits, and other tax implications is not something most professionals will consider on a day to day basis.

Tips for completing your taxes with minimal fuss

Completing your taxes doesn’t always have to be a painful or time-consuming process. There are ways to make keeping track of everything more straightforward.

Track your incomings and outgoings

It is essential to track business income and expenses throughout the year so when it does come to filing your return you do so with accurate and up to date data. Recording what you’ve earned and what you’ve spent is best done using an accounting software package as all the data is held securely online. That said, you may still need to use physical documents outside of the software from time to time. For example if you expand into a small company, you might want to download an income statement template, which can be edited and opened in Excel rather than inside the software.

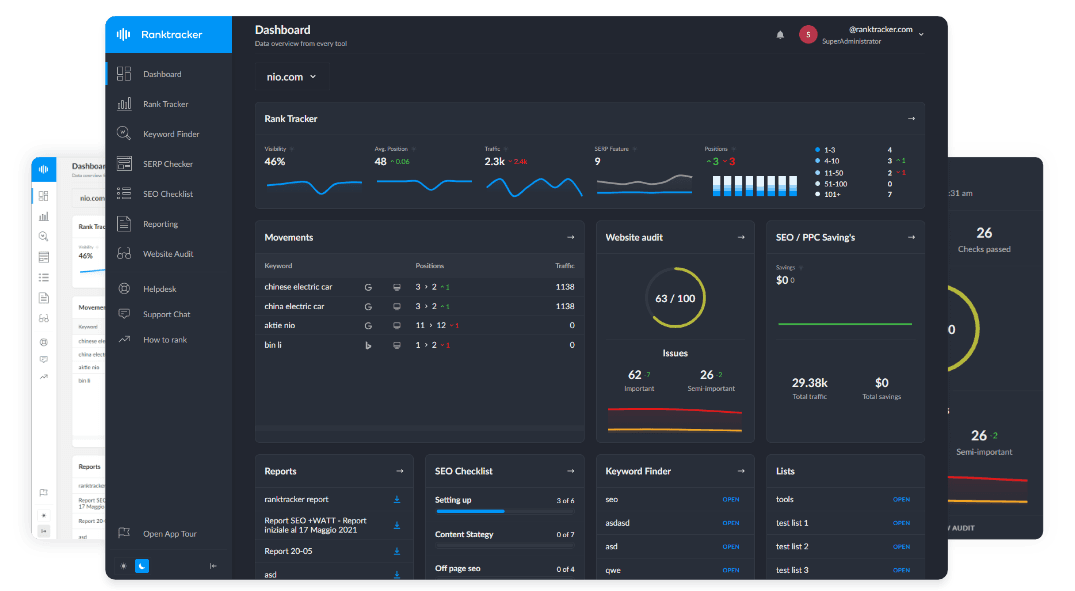

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Set money aside to pay taxes

Opening a separate account to save money for your tax bill will make it easier to avoid spending money you need to save for your tax return. You might want to use a tax calculator periodically to work out roughly how much tax you’re likely to owe on your income after deducting expenses.

To simplify this task even more, you can set up automatic transfers to your savings account, so you won’t even have to remember to do this manually. If you can, adding a little extra can help to cover more tax on months when you have a higher income. Freelancing isn’t an exact science and no two months are the same. Therefore, it’s better to save more than you need, than to save less, then have to find extra money to cover your tax bill. In the event things get too overwhelming or you're unable to organise all necessary tax information in time, remember that filing a tax extension is a viable option. It allows for additional time to ensure your financial records are in order and your taxes filed accurately.

What items can I deduct as a business expense?

Freelancing or running a small business can be costly, but thankfully, there are many things you can add to your expenses to reduce your tax bill (legally).

Equipment and supplies

For digital freelancers, the initial outlay of equipment and supplies that make it possible to run your business can be a big expense. This includes computers, printers, software and business premises if you rent office space instead of working at home. This is a great idea for separating your work and home life, but it’s still an expense. Even small items quickly add up, such as stationery, business cards, and printer ink. Keeping track of all these purchases is crucial so you can add them as expenses to reduce how much tax you need to pay.

Education

Some training courses, workshops and webinars may also be listed as business expenses. The main requirement is that these are linked to your digital freelance work. For example, if you provide graphic design services, you will need to stay up to date with advancements in technology that help you improve your graphic design skills. These change frequently, so you might attend occasional webinars and workshops rather than full courses. These are a viable expense. Other courses that help you improve your business skills that are more generalized, such as learning how to network and improving your marketing skills. No matter what services you provide, learning can help you acquire and retain more customers.

Business travel

If you need to travel for any reason that is related to your business, this can be an expense too. This covers transportation such as flights, mileage, and car rentals – providing the travel is necessary to meet clients, attend conferences related to your business, or can lead to business opportunities, etc.

Home office costs

These may be similar to the expenses for equipment and supplies. Some digital freelancers will choose to work solely from home instead of renting an office space. They find it more convenient, and one of the big lures of freelancing is not having to travel to the office.

Besides the items already mentioned for an office, if you have a dedicated workspace in your home, you may be able to list this as an expense, based on the size of your workspace and the frequency of use. It’s worth getting advice to make sure you list the right amount as an expense. As a guide, you can get a $5 tax reduction per square foot of your home used for business purposes. However, there is a maximum of 300 feet, but that’s a reasonable amount of space for a digital freelancer.

Vehicle expenses

Besides travel, you can also get tax reductions if you have a vehicle you use for business. The costs you list can include gas, oil, repairs, insurance and depreciation. To qualify as a business expense, you must use the vehicle for driving to meet with clients, delivering goods (if applicable), attending business-related events and other work tasks.

Advertising and marketing

As a digital freelancer you can choose to hire outside marketing services or do this yourself. In either case, there will be costs that classify as business expenses. This can include online or offline advertisements, website development and maintenance, brochures/leaflets, and paid social media campaigns.

Professional services

Even if you’re the sole person in your freelance business, at some point, you will need to use outside services. These might be legal advisors, accountants, or financial advisors. For instance, you can visit https://cambreancpa.com/ to explore professional outsourced accounting services tailored to your needs. Each of these professionals can help ensure your business runs smoothly, so they are all viable expenses that can help to lower how much tax you have to pay.

Things you can’t claim as expenses

Not everything can be claimed as a legitimate business expense. However, some freelancers may see certain spending as a grey area. To help clear this up, here are examples of purchases that aren’t usually deductible as business expenses.

Personal travel or food

Being a digital freelancer can give you the freedom to work from anywhere for some or all of your work. Some freelancers enjoy taking working holidays where they spend time abroad while working, but the location has no relevance to their business activities. Travel for this reason (and the meals you buy while you’re there) are not business expenses.

Items for personal use

Items such as a laptop or phone can only be expenses if they are used just for your freelancing. If you purchase a phone contract that rarely or never gets used for business calls, it’s for personal use. However, if you use this phone regularly for work, but also use it for personal reasons, you can claim a proportion as an expense.

Non-business subscriptions

Although subscriptions such as marketing tools, virus software, programs that help with your freelance work, and accounting software are all reasonable expenses. Some other subscriptions aren’t. For example, you may enjoy listening to music while you work and get distracted by adverts between songs. So, you take out a paid subscription to remove the ads. This is not seen as an expense because it doesn’t have a direct and obvious connection to your work and it would be difficult to prove it makes you more productive.

Clothing

Clothing is rarely going to be classed as an expense unless you have a specific uniform or need to wear safety clothing to carry out your work. As this is unlikely to apply to digital freelancers, you would not be able to list this. Any clothing you buy to meet clients or attend events can be worn in your personal time too.

Entertainment

If you meet with a client or potential client, you may be able to list meals as an expense, but entertainment such as a concert or sporting event won’t be eligible. Although these might be a good way to impress a client and break the ice, these aren’t allowed as expenses because it’s impossible to prove the link between entertainment expenses and these bringing in more work for you.

Political contributions

Unlike charitable donations, political contributions are not eligible for tax deductions. These are not necessary for running your freelance business, and the recipients are not a charity. So, if you do decide to contribute to a political cause that you feel strongly about, it won’t lower the amount of tax you pay.

By being aware of what is and isn’t a business expense, you can ensure you pay the lowest amount of tax without breaking any rules. Keeping track of everything, being prepared and not leaving your taxes until the last minute will make things more manageable.