Intro

Running a business in the UK is no small feat, especially when balancing personal and business finances. As an entrepreneur, financial stress can quickly escalate if personal savings, budgeting, and long-term planning aren't carefully managed. This is where personal finance tools step in to offer essential support, helping business owners maintain control of their personal finances while growing their companies.

Whether you're just starting out or you're a seasoned entrepreneur, financial stability outside of your business is critical. Many entrepreneurs face the challenge of irregular income, unexpected expenses, and difficulty saving consistently. Powerful resources exist to help you grow your business, but what about your personal finances? Personal finance tools can tackle these challenges by providing powerful budgeting, saving, and planning features designed to help you make the most of your finances.

Personal Finance Tools to Complement Business Growth

By leveraging tools such as pension calculators, ISA (Individual Savings Account) guides, and tax planning resources, entrepreneurs can set clear financial goals, track savings, and ensure they have enough set aside for retirement.

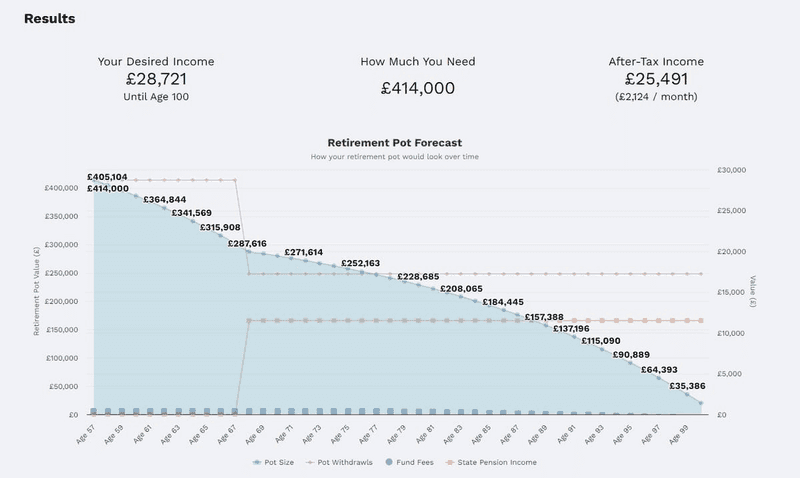

Personal finance platforms offer real-time insights into how small changes in contributions can lead to substantial savings over time. For example, by starting early with a pension plan or contributing regularly to an ISA, entrepreneurs can maximize the benefits of compounding growth and government tax relief. This is vital for those juggling personal and business finances, ensuring that they aren’t left scrambling when unexpected costs arise.

Reducing Financial Stress with Smart Budgeting

For UK entrepreneurs, inconsistent cash flow can often create anxiety when it comes to managing personal expenses. Budgeting tools make it easy to create monthly or annual budgets that take into account both personal and business-related expenses. These features help entrepreneurs set realistic targets, monitor spending, and ensure savings goals are met even during lean business months.

Additionally, many tools provide calculators and planning features that allow business owners to project how much they'll need in savings, whether for future investments or retirement. This kind of forward-thinking planning is essential in reducing financial stress.

Planning for the Future: Why It Matters

Entrepreneurs often focus heavily on business growth, but it’s equally important to ensure long-term personal financial security. Finance tools are ideal for entrepreneurs who want to set up personal pension plans or explore tax-efficient savings vehicles like a Stocks and Shares ISA.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

These tools encourage users to regularly assess their financial situation, helping them identify areas where they could save more effectively. Whether it's reducing personal expenses or optimizing contributions to tax-efficient savings accounts, these small actions can help safeguard your financial future.

The Power of Compounding in Pensions and ISAs

One of the most compelling reasons to invest in pensions and ISAs early is the benefit of compounding returns. Over time, even small, regular contributions can grow substantially as returns are reinvested. For example, consistently contributing to a pension or ISA allows your investments to compound, generating more wealth over time. The earlier you start, the more pronounced these returns become, making compounding a key strategy for entrepreneurs seeking long-term financial security.

Bridging Retirement with an ISA

A common strategy for smart savers is to build a solid pension pot while simultaneously growing a Stocks and Shares ISA. This approach allows the ISA to act as a financial bridge for those who wish to retire early, covering living expenses until they can access their pension. For entrepreneurs seeking flexibility and an earlier retirement, this dual savings strategy offers both security and opportunity.

Keeping Pace with HMRC

Financial plans can only be executed with success when modelled against up-to-date HMRC rules, which drive income tax, national insurance, capital gains tax, ISA limits, pension limits and more. Using an accurate employer NI calculator can help businesses estimate their National Insurance contributions and plan payroll expenses accordingly.

Many tools are not well maintained and may be using last year’s (or worse, even older) tax rates, which results in unreliable and inaccurate outcomes that should not be trusted. As an example, in April 2023, the Annual Allowance for pension contributions increased from £40,000 to £60,000 - a 50% increase - which has a substantial impact on any UK personal finance planning.

Quality personal finance software will be kept up-to-date and should label where tax rates apply and when they have been updated, so you know that the calculations it produces can be trusted.

Optimizing Your Plan

Like in business, optimizing items you can control is crucial for a succinct plan: for example, pension contributions, mortgages, car loans and lifestyle expenditure. The best personal finance software will allow you to supply these as inputs and simulate various possible plans, but many can be overly restrictive or miss out on particular items, failing to paint the bigger picture.

The ultimate goal for many entrepreneurs is financial independence, which requires a strong foundation of personal savings and smart investment strategies. Saving Tool UK equips you with the resources to create a stable personal finance plan, allowing you to focus on business growth without worrying about personal financial struggles.

By offering accessible, practical tools for everything from everyday budgeting to retirement planning, Saving Tool UK helps entrepreneurs achieve peace of mind and financial freedom—allowing them to continue building their business confidently.