Intro

Online payment platforms have altered the way we conduct transactions in the digital era. Their seamless integration into our day-to-day lives has simplified monetary exchanges, empowering businesses and people to engage in transactions across borders effortlessly.

In today's rapidly evolving digital landscape, where there's been a remarkable 42% increase in global cashless payment volumes, mastering online payment platforms becomes increasingly crucial for businesses.

Being a business owner, if you are looking to learn about the importance of digital online payments, its importance, and the top popular payment platforms, check out this blog post. So, let’s get started.

Understanding Online Payment Platforms

Online payment platforms are websites or apps that let you pay for things using the internet. Online payment platforms are important because they make it easy to buy stuff and pay bills without using cash.

You can shop online, order food, pay for services, and even send money to friends and family. Digital payment platforms like Stripe, PayPal, or Facilepay keep your money safe, and you don't have to carry cash or write checks. Incorporating a robust payment solution can ensure that businesses provide secure, flexible payment options that meet customer needs while ensuring seamless transactions. Plus, they work 24/7, so you can pay whenever you want.

Therefore, it becomes crucial for users to master these platforms to navigate the digital sphere confidently, ensuring efficient and secure transactions.

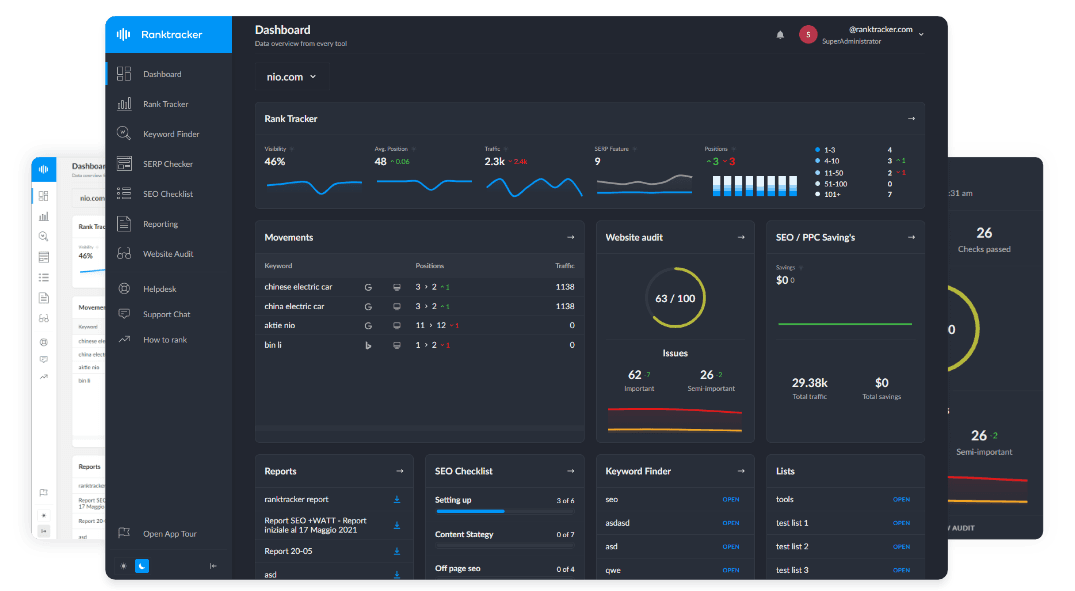

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

To leverage innovative and streamlined payment solutions like FacilePay, visit https://www.facilepay.ca/ website today. Integrating the best payment solutions within your business software and streamline and grow your business with ease.

3 Popular Online Payment Platforms

In the midst of popular online payment platforms, a modest bunch stand as industry goliaths, shaping global transactions with their unique offerings and widespread acceptance. Let’s check out some of them:

1. PayPal

As an established pioneer in online payments, PayPal has become synonymous with secure and convenient transactions worldwide. Its platform facilitates transactions for both businesses and people, offering an easy-to-understand interface that has garnered widespread acknowledgment.

With its simple accessibility and reliability, PayPal remains a go-to decision for clients looking for a familiar and trusted payment method for worldwide transactions, offering competitive exchange rates for sending money from USA to Jamaica and other countries.

Top Features:

- Worldwide transaction facilitation with widespread acceptance

- Secure and trusted payment processing for the users

- Easy-to-understand interface for seamless exchanges

- Buyer and seller protection for secure transactions

- Flexible invoicing and payment management tools

- Integration across various online platforms and websites.

2. Stripe

Stripe stands apart for its developer-friendly tools and robust infrastructure designed explicitly for online exchanges. Its framework offers an elevated degree of customization, permitting organizations to tailor their payment processes.

This payment platform is preferred due to its seamless integration capabilities and extensive support for different programming languages, making it an ideal choice for organizations looking for adaptability and command over their online payment systems.

Top Features:

- Multi-currency support facilitates global transactions

- Real-time data and analytics for informed decision-making

- Robust infrastructure ensures secure online transactions

- Extensive customization options for tailored payment processes

- Developer-friendly tools for seamless integration.

- Subscription billing management for recurring payments.

3. Square

Eminent for its easy-to-understand point-of-sale solutions, Square has expanded its services to include seamless online payment capabilities. Its platform is designed with flexibility, taking care of organizations of different sizes.

With features that can undoubtedly scale with business growth, Square remains an important tool for organizations progressing from physical to online exchanges without compromising client experience or productivity.

Top Features:

- Square has a user-friendly interface for easy transactions

- Expanding services encompassing diverse financial tools

- Efficient and secure payment processing system

- Seamless integration of online payments and point-of-sale systems

- Flexibility to suit different kinds of businesses

- Convenient access across various devices.

Thus, mastering these platforms involves not only familiarity with their functionalities but also aligning their features with specific business needs.

6 Security Measures in Online Payments

In a period of digital exchanges, vigorous safety efforts are vital. Online payment platforms execute different procedures to protect client information and guarantee secure exchanges.

The safety measures include:

1. Encryption Protocols

Encryption is indispensable for secure online transactions, scrambling sensitive data with robust algorithms. This safeguards credit card numbers and individual information during transmission, guaranteeing they stay unreadable to unapproved parties.

This basic safety effort shields against breaches, reinforcing client trust in platform reliability amidst cyber threats.

2. Tokenization Techniques

Tokenization is an additional layer of protection, replacing sensitive data with pointless tokens. If cybercriminals intercept these tokens, they have no intrinsic value and are therefore useless.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Furthermore, even in a breach, tokens are compromised rather than actual sensitive data. This significantly reduces the risk of data breaches, thus safeguarding the user's confidential data.

3. Multi-factor Authentication (MFA)

MFA serves as a crucial defence mechanism by requiring numerous types of ID prior to granting access to accounts. This additional layer of safety demands extra confirmation, for example, biometrics or unique codes sent to registered devices.

MFA essentially supports account security, making it more challenging for unapproved people to get access, regardless of whether they figure out how to get login credentials through different means.

4. Fraud Detection Systems

Advanced fraud detection systems utilize sophisticated algorithms and artificial intelligence to monitor and analyze user activities. It identifies suspicious patterns or anomalies in transactions, flagging and mitigating potential fraudulent activities before they escalate.

This proactive methodology helps to forestall monetary misfortunes and shields both users and the platform from deceitful transactions.

5. PCI DSS Compliance

Adherence to PCI DSS principles guarantees that online payment platforms follow rigid security conventions for dealing with payment information. By fulfilling these industry guidelines, providers carry out measures that secure data storage, encryption, transmission, and overall payment processing, ensuring robust protection of sensitive financial data.

6. User Education and Awareness

Educating clients about safe online practices and potential dangers is vital. Providing guidelines helps users perceive phishing attempts, figure out the significance of secure passwords, and identify potentially fraudulent activities.

This proactive methodology encourages a community of cautious clients, essentially diminishing the probability of cyberattacks and enhancing overall platform security.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Hence, executing a multi-layered security approach cultivates trust and confidence in online transactions. Let’s now learn about the future trends in online payment platforms.

4 Future Trends in Online Payments

The future of online payments guarantees an evolution towards convenience, security, and innovative transaction methods. The upcoming trends in online payments are:

1. Contactless Payment

The future of payments inclines vigorously towards contactless transactions, underscoring comfort and hygiene. Near Field Communication (NFC) technology, QR codes, and wearable gadgets are set to overwhelm, offering consistent, touch-free payment experiences both in-store and online.

2. Rise of Biometric Authentication

Biometric authentication strategies, including fingerprint recognition, facial recognition, and voice authentication, are building momentum. These innovations offer improved security and a more customized payment experience, wiping out the requirement for conventional passwords or PINs.

3. Integration of Cryptocurrencies

Cryptographic forms of money like Bitcoin, Ethereum, and others are progressively being integrated into payment frameworks. As digital currencies gain more extensive acknowledgment, they're becoming feasible options for online exchanges, encouraging quicker, safer, and decentralized payment techniques.

4. Decentralized Finance (DeFi) Integration

The rise of DeFi conventions is reshaping monetary administration, including payments. Smart contracts and blockchain technology are facilitating peer-to-peer transactions, eliminating intermediaries, and offering more transparent and autonomous financial solutions.

Embracing these trends will redefine payment and improve the customer experience, offering clients more secure, proficient, and innovatively advanced strategies for conducting transactions.

Conclusion

Mastering online payment platforms includes adjusting to an evolving landscape of digital transactions. Figuring out encryption, contactless payments, and upcoming trends like biometrics and cryptocurrencies reshapes transaction experiences, guaranteeing safety and effectiveness while emphasizing client-driven approaches.

This is the reason why remaining informed and executing powerful safety efforts are vital for organizations and people to procure and keep up with trust in the consistently advancing digital financial sphere.