Intro

Converting leads into successful clients is the lifeblood of your business. Mortgage lead conversion is the process of turning potential borrowers into actual clients. It involves guiding prospects through the sales funnel, from initial contact to closing a loan. The success of this process directly impacts your bottom line. But how do you know if your efforts are paying off? Measuring and tracking mortgage lead conversion success is crucial to ensuring that your strategies are effective and your business is thriving.

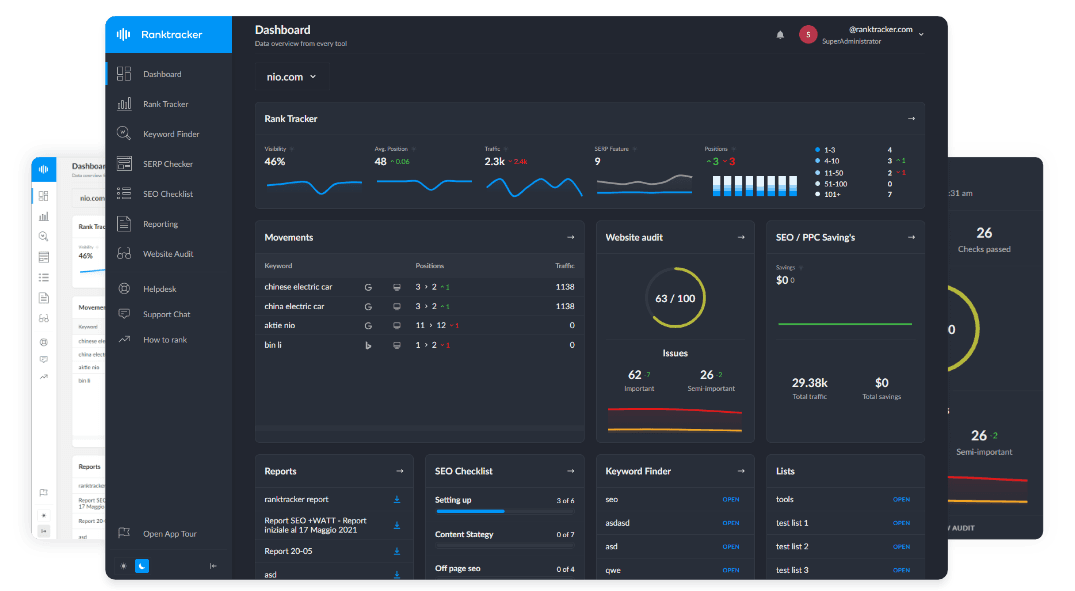

The Role of Mortgage Lead Conversion Software

Utilizing mortgage lead conversion software can be a game-changer for effectively tracking and measuring your conversion. This software automates and streamlines the tracking process, giving you valuable insights into your conversion rates, lead sources, and overall sales performance. If you still need to start using mortgage lead conversion software, it's worth considering as it can save you time and provide you with critical information to refine your strategy.

Key Metrics to Track for Success

Conversion Rate

Your conversion rate is the percentage of leads that turn into actual clients. This metric is fundamental in measuring the success of your lead generation efforts. To calculate your conversion rate, divide the number of converted leads by the total number of leads generated, then multiply by 100.

Lead Response Time

The speed at which you respond to leads can significantly impact your conversion rate. Prospects expect prompt responses, and the faster you reach out, the more likely they are to move forward with you. Track the average time it takes for you or your team to follow up with a lead after they make initial contact.

Cost Per Conversion

Understanding how much you're spending to acquire each converted lead is essential for measuring the efficiency of your marketing efforts. Calculate this by dividing your total marketing spend by the number of conversions.

Lead Source Performance

Not all lead sources are created equal. Some may produce higher quality leads than others. Track which sources—like online ads, social media, or referrals—generate the most conversions.

Customer Lifetime Value (CLV)

This metric helps you understand the long-term value of your converted leads. Customer lifetime value represents the total revenue you can expect from a client throughout your business relationship with them. It's a crucial metric for understanding the profitability of your conversion efforts.

Sales Cycle Length

The sales cycle length is the average time it takes for a lead to move through your sales funnel from the initial contact to closing. Shorter sales cycles often indicate more efficient processes and higher conversion rates. Monitor this to identify any bottlenecks in your sales process.

Tools and Techniques for Tracking Success

Using mortgage lead conversion software is just the beginning. To truly measure and track your success, you should consider implementing a variety of tools and techniques:

- CRM Systems: Customer Relationship Management systems are invaluable for tracking lead interactions. They allow you to record every touchpoint, from the first contact to the final sale, helping you identify trends and improve your approach.

- A/B Testing: Experiment with different strategies and track which ones yield the best results. A/B testing allows you to compare two versions of a marketing campaign, landing page, or follow-up process to see which performs better in lead conversion.

- Regular Reporting: Consistent reporting is key to tracking progress over time. Set up regular reports—weekly, monthly, or quarterly—that detail your key metrics.

Analyzing and Adjusting Your Strategy

Once you've gathered data on your mortgage lead conversion efforts, it's time to analyze it. Look for patterns and trends in your metrics. Are certain lead sources consistently performing better than others? Is there a particular stage in your sales funnel where leads are dropping off? Use this information to adjust your strategies.

For example, if you notice that leads from social media have a higher conversion rate, you may invest more in social media advertising. Or, if your sales cycle length is longer than you'd like, you might focus on improving your follow-up process.

Final Thoughts

Tracking mortgage lead conversion success takes time and effort. As the market evolves and your business grows, so should your strategies. Continuously monitor your key metrics, refine your approach, and stay adaptable. It's not just about generating leads; it's about converting them into satisfied clients who trust you with one of their life's most important financial decisions.