Intro

In today’s financial landscape, the concept of passive income has emerged as a critical strategy for individuals aiming to achieve long-term wealth accumulation and economic stability. This approach aligns with contemporary financial planning principles, emphasizing the importance of creating revenue streams that can sustain an individual’s lifestyle without the need for continuous labor.

So, whether you're at the beginning of your quest for financial independence or looking to diversify and strengthen your income streams, this guide is your compass. It’s designed to light the way, offering both the vision and practical steps needed to navigate the journey ahead.

What Is Passive Income?

Passive income is earnings from a venture in which a person is not actively involved daily. Unlike active income, which is earned through performing a service or direct labor, passive income is generated with minimal daily effort to maintain or grow it after the initial setup or investment. This type of income is highly sought after because it can provide financial stability and freedom, allowing individuals to earn money without being tied down to a conventional job or work schedule.

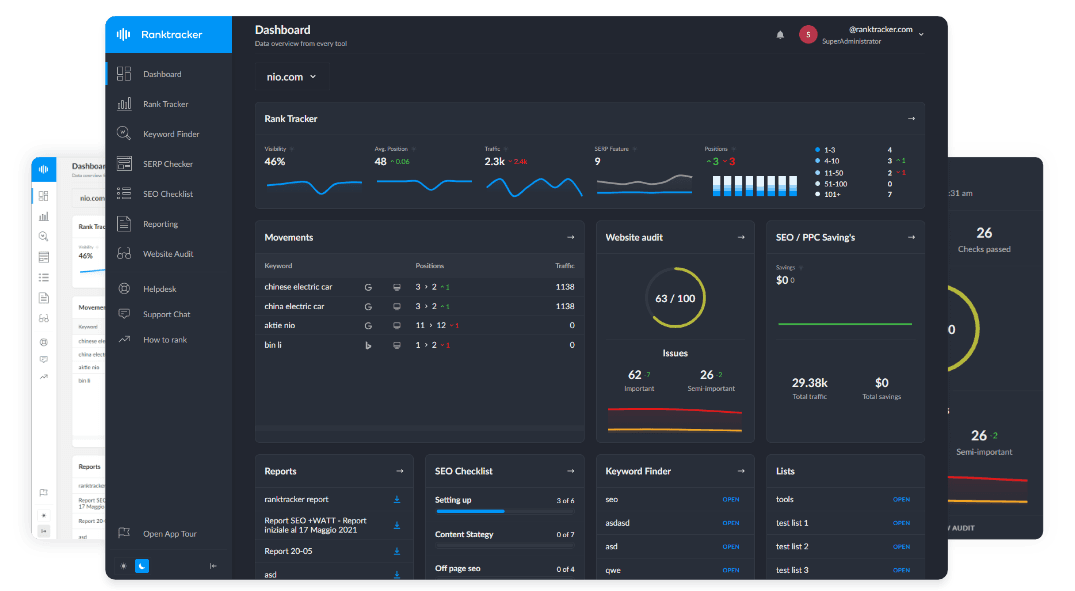

One popular method to learn about and implement passive income strategies is through a review blog that specializes in passive income ventures. These blogs can offer valuable insights, detailed guides, and personal experiences from individuals who have successfully created passive income streams. This resource becomes invaluable as it not only demystifies the process but also highlights the diverse ways one can achieve financial independence through passive income.

Passive Income Strategies

These strategies are diverse, each offering unique benefits and risks, and they require careful consideration and planning to implement successfully. Here are several key passive income strategies to try:

Investment Income

Dividend Stocks:

Investing in dividend-paying stocks is a popular strategy for generating passive income. Companies distribute a portion of their profits to shareholders in the form of dividends. By building a portfolio of these stocks, investors can receive regular payments that can be reinvested or used as income.

Bonds And Fixed-Income Securities:

Bonds and other fixed-income securities provide interest payments over a predetermined period. These can be government bonds, corporate bonds, or municipal bonds, each offering different risk and return profiles.

Mutual Funds And Exchange-Traded Funds (ETFs):

These Mutual funds can offer exposure to a diversified portfolio of dividend stocks or interest-bearing securities, spreading the risk and potentially providing a steady income stream through dividends or interest payments.

Real Estate

Rental Properties:

Purchasing property to rent out is a classic passive income strategy. It involves initial investment and effort in acquiring and preparing a property, but once rented, it can provide a consistent monthly income. Property management companies can be employed to handle day-to-day operations, making them more passive.

Real Estate Investment Trusts (REITs):

For those interested in real estate without direct ownership responsibilities, REITs offer a way to invest in real estate markets through the purchase of shares in commercial, residential, or industrial real estate portfolios.

Digital Products And Online Ventures

E-books And Online Coaching Courses:

Creating and selling digital products, such as e-books or online coaching courses, requires an upfront investment of time and possibly money. Once created, these products can be sold repeatedly without additional production costs, generating passive income.

Blogging And Affiliate Marketing:

Starting a blog or website and monetizing it through affiliate marketing, where you earn commissions by promoting other companies' products, can become a significant source of passive income. This strategy requires effort upfront to create content and build an audience.

YouTube Channels And Podcasts:

Like blogging, creating content for YouTube or podcasts can generate income through ad revenue, sponsorships, and affiliate marketing. After establishing a solid subscriber base, these platforms can offer regular passive income.

Intellectual Property

Royalties From Writing Or Music:

Authors, musicians, and creators can earn royalties from their books, songs, or other creative works. After the initial creation, these works can continue to generate income whenever they are sold or used.

Patents And Licensing:

Inventing a product and patenting it allows the inventor to earn royalties by licensing the patent to others who want to use the invention in their products.

Automated Businesses

Dropshipping And E-commerce:

Setting up an online store where products are shipped directly from the supplier to the customer can create a passive income stream. While dropshipping requires effort to set up and market the store, the day-to-day operations can be automated or outsourced.

App Development:

Developing a mobile app involves significant upfront work but can generate passive income through app sales, in-app purchases, or advertisements once it's launched and gaining traction.

The Power Of Passive Income

The power of passive income lies in its potential to transform personal finances, providing a stable foundation for wealth accumulation. Here are several benefits that underscore the power of passive income:

Achieving Financial Independence

Central to the appeal of passive income is its pivotal role in attaining financial independence. This condition, where one's living expenses are entirely met by income from investments or other passive sources, emancipates individuals from reliance on traditional employment. It unlocks a world where work becomes a choice rather than a necessity, enabling people to pursue their passions, engage in voluntary work, or simply enjoy leisure and family time without financial constraint.

Exponential Wealth Growth

Passive income streams, especially those rooted in investments like the stock market or real estate, harness the power of compounding returns. This means that the returns themselves generate further earnings, setting the stage for exponential wealth growth over time. Such a mechanism can significantly amplify one's financial resources, surpassing what is typically achievable through salary-based earnings alone.

Liberation Of Time

Arguably, the most transformative aspect of passive income is the liberation it offers — freedom from the time-for-money trade-off that defines most people's working lives. This newfound time wealth allows individuals to dictate their schedules, pursue hobbies, travel, or invest time in relationships and personal development, all without the looming pressure of financial obligations.

Mitigation Of Financial Anxiety

The stability provided by reliable passive income streams acts as a buffer against life's uncertainties. Whether facing economic recessions, industry shifts, or personal challenges that impact one's ability to work, having a diversified portfolio of passive income can mitigate financial anxiety, ensuring a level of lifestyle continuity that is often unattainable through active income alone.

Facilitation Of Early Retirement

For those aspiring to retire early, passive income is not just a strategy but a necessity. It enables the accumulation of sufficient resources to retire and maintain a desired lifestyle indefinitely without active employment. This aspect of passive income can dramatically alter life's trajectories, offering the freedom to enjoy one's prime years unencumbered by work obligations.

Unlimited Scalability

Unlike traditional jobs, where earnings are intrinsically linked to the number of hours worked, passive income has no such limitations. Its scalability means that efforts to expand or refine income streams can result in disproportionate increases in earnings, allowing for significant financial growth without a corresponding increase in labor.

Risk Diversification

By cultivating multiple sources of passive income, individuals can shield themselves from the volatility and uncertainties of any single market or investment. This diversification strategy not only enhances financial security but also provides a rich learning curve as one navigates through different investment landscapes, building resilience and adaptability.

Legacy And Generational Wealth

Beyond personal financial security, passive income has the potential to build generational wealth. By establishing and nurturing income-generating assets, individuals can create a financial legacy that supports their loved ones for generations, offering educational opportunities, startup capital for businesses, or simply financial security.

Step-By-Step Guide To Getting Started With Passive Income

Starting with passive income can be a transformative step toward financial freedom and security. This journey involves several key steps, from understanding your financial situation to choosing and managing your passive income streams. Here's a guide to help you get started:

Understanding Your Financial Landscape

The first step in your passive income journey involves a thorough assessment of your current financial health. This means taking a comprehensive look at your income sources, monthly expenses, existing debts, and savings. Establishing clear, achievable objectives—whether it's supplementing your current income, funding your retirement, or achieving financial independence—is essential for guiding your actions and measuring your progress.

Educational Foundation

A solid understanding of the various passive income streams is crucial. Dedicate time to researching different avenues, such as real estate investments, dividend-paying stocks, creating digital content, or venturing into the e-commerce space. Understanding the potential returns and inherent risks associated with your chosen passive income strategy will enable you to make informed decisions and set realistic expectations.

Financial Preparation

Building a stable foundation for your passive income efforts starts with financial preparation. This includes establishing an emergency fund that covers at least three to six months of living expenses, providing a financial cushion that allows you to navigate unforeseen circumstances without derailing your passive income plans. Additionally, prioritizing the reduction of high-interest debt is paramount. High-interest liabilities, especially consumer debt like credit card balances, can significantly eat into your potential earnings from passive income sources.

Strategic Selection

Choosing the right passive income stream is a personal decision that should align with your interests, skills, and financial goals. Whether you're drawn to the tangible nature of real estate or the digital realm of content creation, starting with a venture that resonates with you will increase your chances of success and fulfillment. It's advisable to start small, allowing you to learn and adjust without the pressure of significant financial commitment.

Action Plan

With a chosen passive income stream in mind, it's time to formulate a detailed plan. This involves setting up a budget that accounts for initial investments, potential ongoing expenses, and any tax implications of your new income stream. Developing a timeline with clear milestones will help you stay on track and measure your progress.

Implementation And Commitment

Taking the plunge and launching your passive income venture is a critical step. This could mean purchasing your first investment property, starting a blog, or investing in a portfolio of dividend stocks. Initial efforts and investments can be demanding, but staying committed and keeping your eyes on the long-term benefits is vital.

Performance Evaluation

Once your passive income stream is operational, regular monitoring and assessment are vital. Analyzing its performance allows you to identify areas for improvement and optimization. Adjusting your strategy for better returns might involve reinvesting profits, tweaking your approach, or even scaling up operations to enhance profitability.

Diversification And Growth

As you become more comfortable and successful with your initial passive income source, consider exploring additional avenues. Diversifying your income streams can enhance your financial stability and reduce dependency on a single source of income. Strive for a balanced mix of investments to manage risk effectively while seeking growth opportunities.

Reinvestment Strategy

A powerful aspect of passive income is the potential for compounding growth through reinvestment. By channeling your passive income back into your ventures or exploring new opportunities, you can accelerate your wealth accumulation and expand your financial portfolio.

Continuous Learning And Adaptability

The landscape of passive income opportunities is continually evolving, driven by economic trends, technological advancements, and market demand. Staying informed about new opportunities, strategies, and potential shifts in the market will enable you to adapt and refine your approach, ensuring your passive income streams remain robust and productive.

Conclusion

By leveraging resources effectively, seeking out knowledge through credible channels, and staying committed to the goal of financial autonomy, anyone can embark on this rewarding path. The journey towards building passive income is not without its challenges, but the potential for creating a sustainable, wealth-generating ecosystem makes it a venture worth pursuing.