Intro

Finance has always been built on trust — and in 2025, that trust is being tested in a new way. Consumers aren’t just Googling investment options anymore; they’re asking AI-powered assistants to guide their financial decisions.

“What’s the safest way to invest $10,000 right now?”

“Which banks offer the best high-yield savings accounts?” “Is crypto still a good investment in 2025?”

These queries go straight to Google SGE, Bing Copilot, ChatGPT, Perplexity.ai, and You.com, where AI generates tailored advice by summarizing data from verified, transparent sources.

For financial institutions, fintechs, and advisors, this shift means one thing: if your data isn’t structured, credible, and AI-trustworthy, you’re excluded from the conversation.

That’s why financial brands now need AI Optimization (AIO) — a strategy designed to ensure that your company, products, and advice are not just visible, but trusted by AI systems generating financial guidance.

Why AIO Matters for Finance

Finance is a high-stakes category in AI search. Generative systems prioritize verified data and transparent brands while filtering out vague, promotional, or misleading advice.

AIO (AI Optimization) ensures your financial brand meets those trust and compliance thresholds — helping you appear in AI-generated recommendations, comparisons, and educational summaries.

AIO helps financial brands:

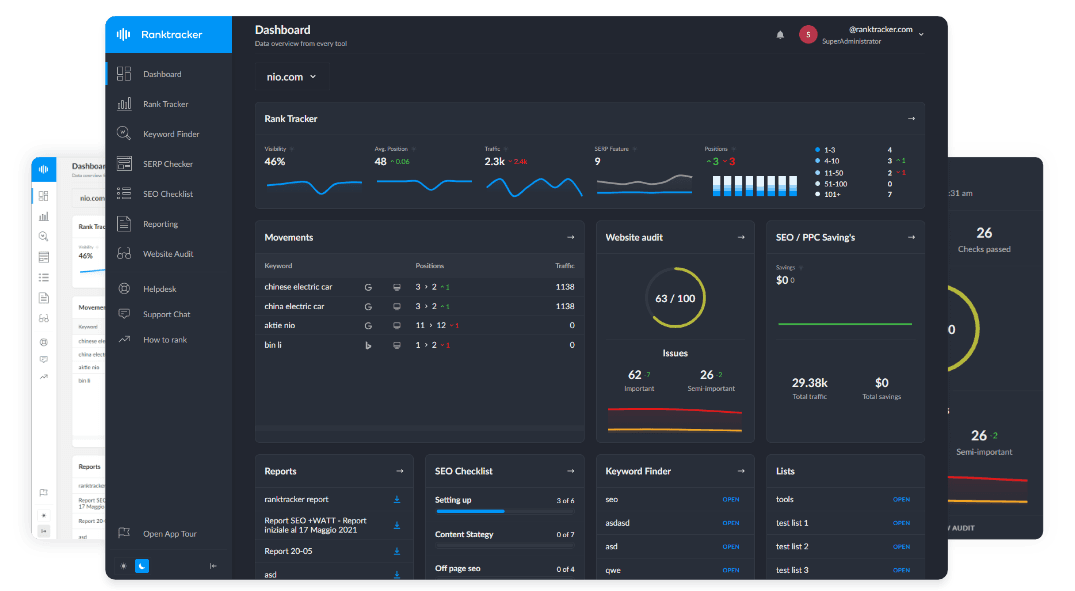

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

✅ Get cited in “best savings accounts” or “how to invest” AI responses.

✅ Strengthen brand credibility with transparent compliance data.

✅ Structure rates, fees, and performance data for AI interpretation.

✅ Build consumer trust in AI-curated recommendations.

In short — AIO helps you become the source AI trusts to quote.

Step 1: Structure Financial Products with Verified Data

AI systems begin by identifying your financial products and their key attributes.

✅ Add FinancialProduct schema to each product page:

{

"@type": "FinancialProduct",

"name": "EverSave High-Yield Savings Account",

"description": "A flexible, FDIC-insured savings account offering 4.35% APY with no monthly fees.",

"interestRate": "4.35%",

"feesAndCommissionsSpecification": "No monthly maintenance fees",

"provider": {

"@type": "BankOrCreditUnion",

"name": "EverSave Bank"

},

"areaServed": "United States",

"currency": "USD"

}

✅ Include clear, factual attributes like APY, fees, and coverage details.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

✅ Link to verified regulatory sources (FDIC, FINRA, SEC).

✅ Use consistent terminology — AI systems rely on semantic accuracy.

Ranktracker Tip: Run Web Audit to confirm your structured data matches your on-page details. Mismatched numbers or outdated rates can break AI trust.

Step 2: Add Compliance and Regulatory Transparency

Generative engines are cautious with financial advice — they only summarize information from compliant entities.

✅ Include legal and regulatory metadata:

{

"@type": "Organization",

"name": "EverSave Bank",

"identifier": {

"@type": "PropertyValue",

"name": "FDIC Certificate Number",

"value": "34819"

},

"memberOf": {

"@type": "Organization",

"name": "Federal Deposit Insurance Corporation (FDIC)"

}

}

✅ Display clear licensing information, disclosures, and disclaimers.

✅ Add LegalDisclaimer schema for risk statements:

{

"@type": "LegalDisclaimer",

"text": "Investment products are not FDIC insured and may lose value. Past performance does not guarantee future results."

}

✅ Publish a compliance page linking all legal identifiers and memberships.

Step 3: Structure Financial Education Content

AI engines frequently cite financial education resources when explaining terms or strategies.

✅ Create factual, clearly structured guides such as:

-

“How Compound Interest Works”

-

“Understanding APR vs APY”

-

“Best Low-Risk Investment Options in 2025”

✅ Add HowTo or FAQPage schema for these guides:

{

"@type": "FAQPage",

"mainEntity": [{

"@type": "Question",

"name": "What is compound interest?",

"acceptedAnswer": {

"@type": "Answer",

"text": "Compound interest is the process where interest is calculated on both the initial principal and accumulated interest from previous periods."

}

}]

}

✅ Link to authoritative external sources like the SEC, CFPB, or central banks.

Ranktracker Tip: Use Keyword Finder to identify trending financial questions appearing in AI recommendations (“how to build wealth safely,” “is refinancing worth it”).

Step 4: Highlight Real Data and Disclosures

AI systems penalize vague or missing information — especially in finance.

✅ Include visible and machine-readable details for:

-

Interest rates and ranges

-

Minimum balances or investment thresholds

-

Risk levels (low, moderate, high)

-

Historical performance (for funds or portfolios)

✅ Add Dataset schema for performance or rate tables:

{

"@type": "Dataset",

"name": "EverSave Historical Interest Rates 2023–2025",

"creator": "EverSave Bank",

"variableMeasured": [

{"@type": "PropertyValue", "name": "2023 Average APY", "value": "3.90"},

{"@type": "PropertyValue", "name": "2025 Average APY", "value": "4.35"}

]

}

This allows AI engines to cite your data when summarizing rate trends.

Step 5: Add Author Expertise and Review Credentials

AI assistants prefer content written by verified experts — not anonymous contributors.

✅ Add Person schema for authors and reviewers:

{

"@type": "Person",

"name": "Michael Torres, CFA",

"jobTitle": "Senior Investment Analyst",

"hasCredential": {

"@type": "EducationalOccupationalCredential",

"credentialCategory": "Chartered Financial Analyst (CFA)"

},

"sameAs": [

"https://www.linkedin.com/in/michaeltorrescfa"

]

}

✅ Include “Reviewed by” or “Fact-checked by” sections on all educational content.

✅ Display credentials (CFA, CFP, CPA) prominently and link to verification sources.

This adds the E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness) signals AI systems require for financial inclusion.

Step 6: Build AI-Readable Comparison Content

AI engines are powered by factual comparisons between products.

✅ Create structured “best of” and “vs” articles:

-

“Best Savings Accounts in 2025”

-

“Robo-Advisors vs. Traditional Brokers”

✅ Use ItemList schema for ranked comparisons:

{

"@type": "ItemList",

"name": "Top High-Yield Savings Accounts 2025",

"itemListElement": [

{"@type": "ListItem", "position": 1, "name": "EverSave Bank – 4.35% APY"},

{"@type": "ListItem", "position": 2, "name": "CapitalOne – 4.25% APY"}

]

}

✅ Keep data verifiable — include rates, fees, and links to official product pages.

Ranktracker Tip: Use SERP Checker to see if your product appears in AI summaries and identify which competitors are being cited.

Step 7: Add Customer Reviews and Trust Signals

AI assistants measure brand credibility partly through user sentiment.

✅ Display verified customer testimonials and feedback.

✅ Mark them up with AggregateRating schema:

{

"@type": "AggregateRating",

"ratingValue": "4.7",

"reviewCount": "512"

}

✅ Link to verified reviews on Trustpilot, Google, or NerdWallet.

✅ Include trust badges (BBB, ISO 27001, or regulatory seals) where applicable.

Step 8: Maintain Transparency and Recency

Outdated or opaque financial data damages AI credibility.

✅ Update all product pages quarterly (or when rates change).

✅ Include dateModified metadata for every article and product page.

✅ Display clear timestamps for all market data or analysis.

AI prioritizes timely, transparent, and consistent financial information above all else.

Step 9: Measure Financial AIO Performance with Ranktracker

| Goal | Tool | Function |

| Validate financial schema | Web Audit | Check FinancialProduct, Organization, and LegalDisclaimer schema |

| Track AI financial queries | Rank Tracker | Monitor performance for “best accounts,” “investment tips,” etc. |

| Discover advice queries | Keyword Finder | Find conversational “how to invest” or “should I…” queries |

| Analyze brand mentions | SERP Checker | Detect inclusion in AI-generated financial overviews |

| Track backlinks | Backlink Monitor | Measure authority from financial directories and regulators |

Step 10: Build a Financial Knowledge Graph

To dominate AI results long-term, your financial brand needs a connected entity structure.

✅ Link organization → products → rates → authors → compliance pages. ✅ Use sameAs links for verified listings (LinkedIn, Crunchbase, Bloomberg).

✅ Ensure each product or guide connects back to your main brand entity.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

This network forms a trust graph that AI systems rely on when generating financial advice.

Final Thoughts

In 2025, AI is the new financial advisor — and it only recommends what it can verify.

By structuring your data, adding credentials, and maintaining transparent compliance signals, your financial brand can earn its place in AI-generated advice and comparisons.

With Ranktracker’s Web Audit, Keyword Finder, SERP Checker, and Backlink Monitor, you can measure your financial visibility in AI search ecosystems — ensuring your institution remains not only visible but trusted by machines and humans alike.

Because in finance, visibility is valuable — but trust is everything.