Intro

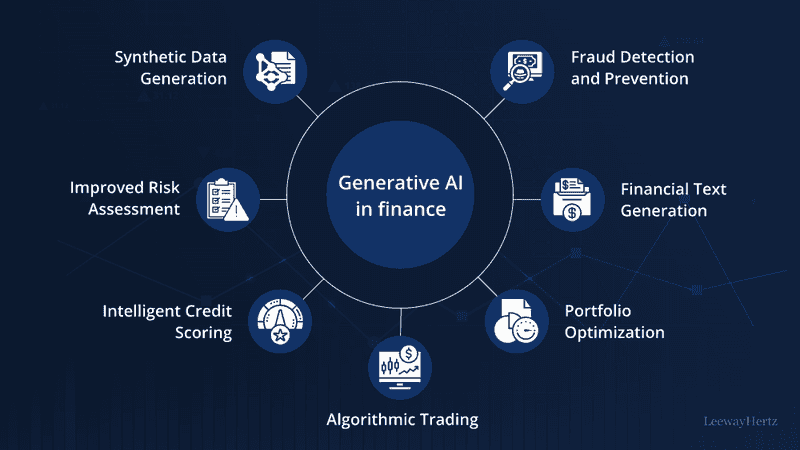

Fintech companies sit at the intersection of technology, finance, and trust.

They promise:

- Convenience over traditional banks

- Better pricing or access

- Smarter automation

- Faster decisions

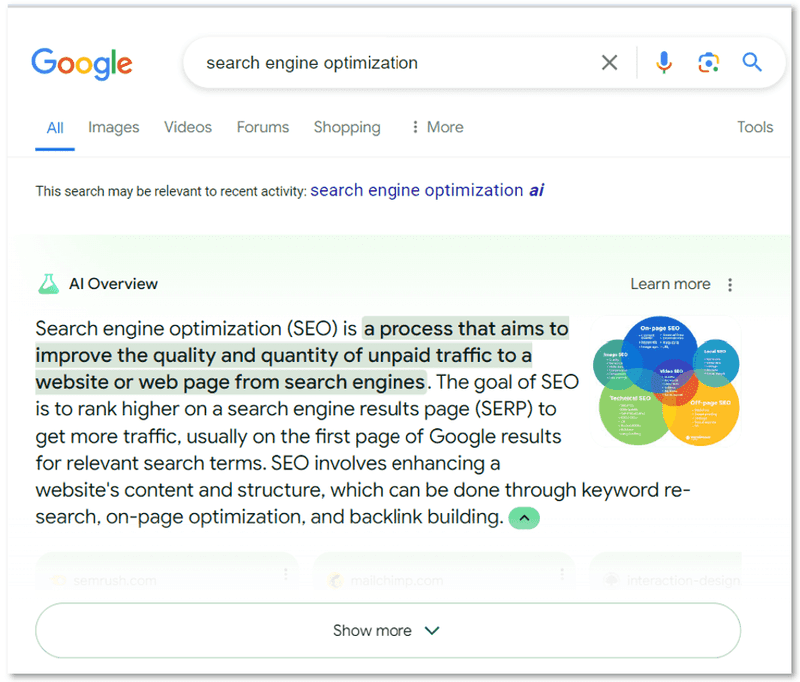

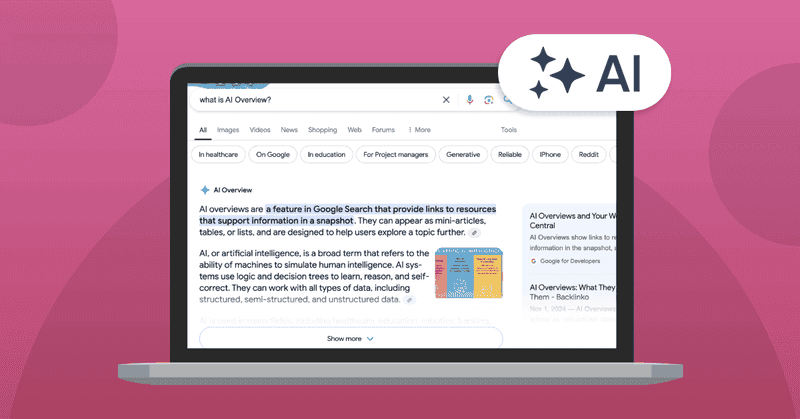

AI Overviews fundamentally change how those promises are evaluated.

Google is no longer just ranking fintech landing pages, comparison posts, or review articles. It is explaining what a fintech product does, how safe it is, who it’s for, and what the risks are — directly in the SERP.

For fintech companies, this is not just an SEO evolution. It is a credibility gate.

This article is part of Ranktracker’s AI Overviews series and goes deep into how AI Overviews affect fintech companies specifically, how fintech buyer behaviour changes, how Google selects sources in a high-trust financial environment, what content actually influences AI summaries, and how fintech brands can stay visible, compliant, and chosen in an AI-first search landscape.

1. Why AI Overviews Matter More for Fintech Than Traditional SaaS

Fintech products deal with real money, real risk, and real consequences.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

That places them closer to YMYL than to standard SaaS.

Fintech Queries Trigger AI Overviews by Default

Common searches include:

- “Is [fintech app] safe?”

- “How does [fintech] work?”

- “[Fintech] vs bank”

- “Best fintech app for budgeting”

- “Is fintech better than traditional banking?”

These queries used to drive traffic to:

- Blog explainers

- Review sites

- Comparison pages

Now, Google often answers with a guarded, neutral AI Overview.

If your fintech brand is not trusted enough, it may be omitted — even if you rank.

Fintech Is Evaluated on Safety First, Innovation Second

AI Overviews prioritise:

- Security

- Compliance

- Transparency

- Risk disclosure

Innovation language without trust signals is filtered out.

2. How AI Overviews Reshape the Fintech Buyer Journey

AI Overviews compress fintech evaluation into a trust checkpoint.

Awareness → Safety Framing

AI Overviews define:

- Whether the product is regulated

- What it replaces (bank, broker, lender)

- What protections exist

- What risks users should understand

This framing happens before your onboarding page is seen.

Comparison → Risk Filtering

Instead of feature-by-feature comparisons, users ask:

- “Is this safe?”

- “Is this legitimate?”

- “What happens if something goes wrong?”

AI Overviews heavily influence these judgments.

Conversion → Informed (or Blocked) Adoption

When users do click:

- They expect disclosures

- They expect nuance

- They expect alignment with what Google explained

Mismatch here kills conversion trust instantly.

3. The Fintech Attribution Blind Spot

Fintech teams may notice:

- Declining organic traffic

- Higher-quality signups

- Better onboarding completion

- Lower early churn

This feels contradictory.

Your content may:

- Influence AI summaries

- Pre-educate users

- Filter high-risk or misaligned signups

But analytics say:

“SEO traffic is down”

In reality:

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

SEO is influencing who trusts you enough to start.

AI Overviews create pre-qualified fintech users.

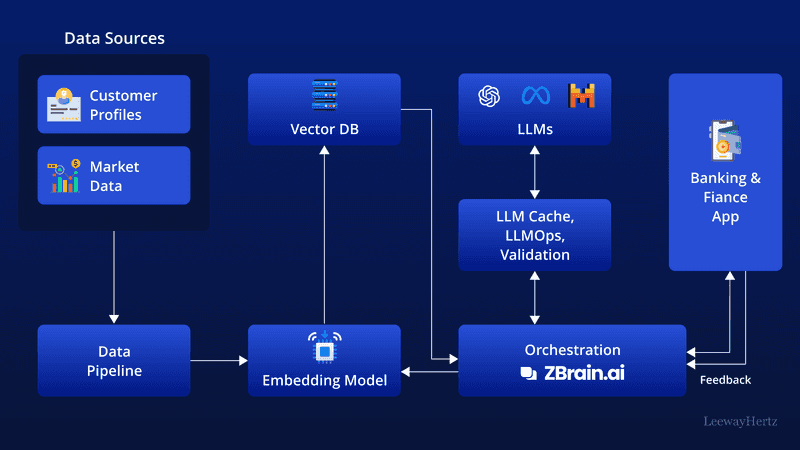

4. How Google Chooses Sources for Fintech AI Overviews

Google applies finance-grade trust heuristics to fintech.

4.1 Compliance and Regulation Signals Are Mandatory

AI Overviews favour sources that:

- Clearly state regulatory status

- Explain jurisdictional limits

- Mention licenses and oversight

- Avoid regulatory ambiguity

Unclear compliance language is disqualifying.

4.2 Neutral Explanation Beats Product Promotion

AI penalises:

- “Best app” claims

- Aggressive growth language

- Guaranteed outcomes

- Fear-based conversion tactics

Educational framing wins.

4.3 Entity-Level Trust Beats Page-Level SEO

Google evaluates fintech brands as entities, not websites.

Signals include:

- Brand mentions

- Press coverage

- Regulatory references

- Consistent explanations across the site

- Absence of misleading claims

One misleading article can affect the entire domain.

4.4 Stability Over Time Matters

Frequent pivots in:

- Messaging

- Positioning

- Claims

Reduce AI trust.

AI prefers fintech brands that evolve carefully and transparently.

5. The Strategic Shift for Fintech SEO

Old Fintech SEO

- Rank high-intent keywords

- Push features and benefits

- Monetise aggressively

- Scale content rapidly

AI-First Fintech SEO

- Build institutional credibility

- Educate before selling

- Reduce hype

- Become the “safe explanation” Google uses

If Google doesn’t feel safe explaining your product, it won’t.

6. Content Types That Influence AI Overviews for Fintech Companies

6.1 “How It Works” Core Explainers

Examples:

- “How digital wallets work”

- “How fintech budgeting apps access bank data”

- “How automated investing manages risk”

These anchor AI explanations.

6.2 Security and Risk Transparency Pages

AI Overviews pull from content that explains:

- Data protection

- Encryption

- Failure scenarios

- User responsibilities

Transparency increases trust.

6.3 Fintech vs Traditional Alternatives

AI trusts content that explains:

- Trade-offs vs banks

- Limitations vs incumbents

- Where fintech is better — and where it isn’t

Neutrality signals credibility.

6.4 Regulatory and Consumer Protection Content

Explaining:

- Deposit protection

- Insurance coverage

- Jurisdictional differences

- Complaints and escalation paths

Aligns with Google’s harm-reduction goals.

7. How to Structure Fintech Content for AI Overviews

Lead With Safety and Scope

Every major page should clearly state:

- What the product does

- What it does not do

- Who it’s regulated by

- What risks exist

AI extracts early content aggressively.

Use Conditional, Precise Language

Phrases like:

- “Typically”

- “Depending on jurisdiction”

- “May vary”

- “Subject to regulation”

Increase AI trust significantly.

Centralise Definitions and Claims

Winning fintech sites:

- Use consistent definitions

- Avoid internal contradictions

- Maintain one interpretation of key terms

AI punishes inconsistency harshly.

8. Measuring Fintech SEO Success in an AI Overview World

Traffic volume is no longer the KPI.

Fintech teams should track:

- Keywords triggering AI Overviews

- Brand inclusion in AI summaries

- Onboarding completion rates

- Trust-related drop-offs

- User understanding at signup

SEO becomes trust acquisition infrastructure, not traffic acquisition.

9. Why AI Overview Tracking Is Critical for Fintech Companies

Without AI Overview tracking, fintech companies lose visibility into how Google judges their trustworthiness.

You won’t know:

- Whether your brand is included or excluded

- Which competitors are seen as safer

- When messaging weakens trust

- Where compliance explanations are missing

This is where Ranktracker becomes essential.

Ranktracker enables fintech teams to:

- Track AI Overviews per fintech keyword

- Monitor desktop and mobile AI summaries

- Compare AI visibility with Top 100 rankings

- Detect trust erosion before growth stalls

You cannot manage fintech SEO without AI-layer observability.

10. Conclusion: AI Overviews Decide Which Fintech Products Are Safe Enough to Be Explained

AI Overviews do not reward fintech disruption. They reward fintech responsibility.

In an AI-first fintech SERP:

- Safety beats innovation

- Neutrality beats hype

- Consistency beats speed

- Trust beats rankings

Fintech companies that adapt will:

- Maintain visibility despite reduced traffic

- Attract better-fit users

- Reduce regulatory and churn risk

- Influence adoption decisions at scale

The fintech SEO question has changed.

It is no longer:

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

“How do we rank fintech keywords?”

It is now:

“Does Google trust us enough to explain financial technology using our words?”

Those who earn that trust define the future of fintech discovery.