Intro

Quality personal finance content empowers readers to take control of their money, providing practical, unbiased advice to help with budgeting, debt, retirement and more. Finance keywords are some of the most lucrative around, and many have high search volume to drive large organic traffic.

This article will equip you to create compelling, useful personal finance content that builds reader trust and credibility.

You'll learn how to optimize personal finance content for SEO through research, keywords, and engagement so your articles stand out from the misinformation and attract backlinks and shares.

Why is Quality Important For Personal Finance Content?

Before we even go into the rewards like traffic and sales, let’s think about it differently: you have the chance to help people make the right money decisions for their lives – that’s an incredibly powerful thing.

Well-known personal finance bloggers, such as Sammie Ellard-King of Up The Gains, have built powerful brands by prioritizing quality over everything else.

Personal finance articles that provide practical, actionable advice empower readers to take control of their money. For example, content on budgeting helps readers organize their finances, while retirement planning content gives them strategies to build their nest egg.

Additionally, quality content builds your trust and credibility – especially if you’re writing for other sites with your name listed, and generally growing your influence in the niche as an expert. A key element in EEAT for SEO is your authoritativeness – this comes from guest posting and being quoted in trusted outlets, and having these links from seed sites.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Kasra Dash from Searcharoo calls this a “branded SERP” for your author. For a YMYL topic like personal finance, being high quality, and appearing on many outlets, is essential. You can search your name and your niche, and see how many relevant results come up in Google, to see how branded your SERP is.

Great personal finance content also tends to garner more backlinks and social shares, giving you exposure, and letting you rank for more competitive keywords.

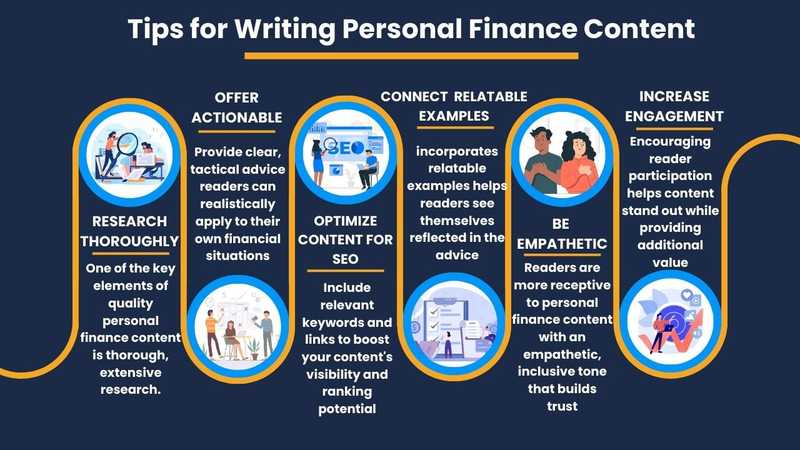

Tips for Writing Personal Finance Content

1. Research Thoroughly to Demonstrate Expertise

One of the key elements of quality personal finance content is thorough, extensive research. Writers should back up their articles with:

- Credible statistics

- Insightful studies

- And expert perspectives.

This is essential to strengthen their expertise on the topic.

For statistics, turn to reputable government sources like the Bureau of Labor Statistics for the latest data on topics like consumer debt, income trends, and retirement savings. References to studies from financial institutions or organizations like The National Institute on Retirement Security also provide crucial data on financial preparedness and trends.

Expert insights help demonstrate credibility, so quote financial planners, accountants, financial advisors, and other accredited professionals within your content when possible. Their qualified advice boosts your authority. Just make sure to only reference experts with established positive reputations.

2. Offer Actionable, Practical Personal Finance Tips

Provide clear, tactical advice readers can realistically apply to their own financial situations. Focus on including specific steps and tips to help readers manage their money better, and give examples that they can relate to.

For example, when writing about eliminating credit card debt, don’t just explain why it’s important. Give action steps like applying for a debt consolidation loan or consolidating multiple high-interest debts with a 0% APR balance transfer card.

Retirement planning articles should include practical tips like setting up automatic contributions from each paycheck and steadily increasing 401k contribution amount by 1% annually to work towards the recommended 10-15%.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

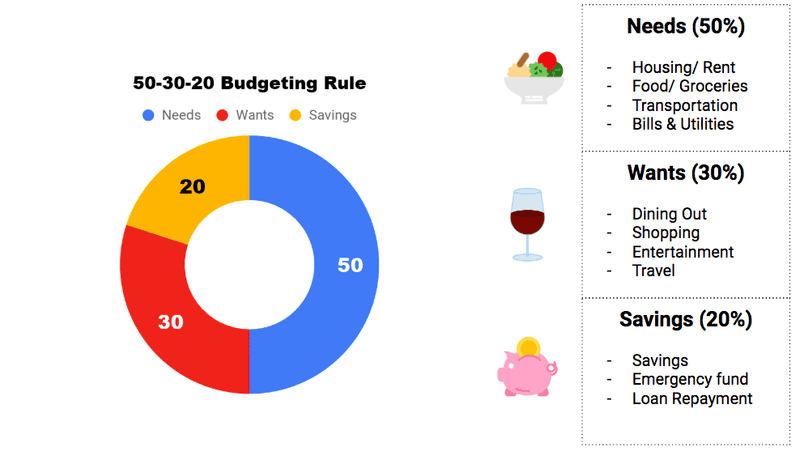

Budgeting articles should note the 50/30/20 budget formula, and then provide instructions on tracking expenses using spreadsheet templates or budgeting apps.

The more detailed and actionable the advice, the better. Break down big money concepts into easy-to-implement steps. Help readers understand what to do and how to do it. Give them practical finance tips they can start applying immediately to take control.

3. Optimize Content for SEO

Creating finance content with SEO best practices is crucial for driving traffic. Include relevant keywords and links to boost your content's visibility and ranking potential.

Be intentional with keywords, working primary and secondary keywords into headings, subheadings, image alt text, and naturally within paragraph copy. For example, for a retirement planning article, focus on keywords like "retirement planning tips" and "retirement advice."

Sammie Ellard-King, Founder of Up The Gains, the fastest-growing personal finance website in the UK, completely agrees, stating:

“Making sure your personal finance content is optimised for SEO is absolutely essential. There’s no point writing an amazing article, and then nobody finds it because you haven’t made it easy for a search engine to understand and rank!” – Sammie Ellard-King

Link out to other helpful, authoritative finance resources where relevant to provide additional value. This also helps build relationships with sites you'd want to earn backlinks from. Just make sure they are reputable and add true value for the reader.

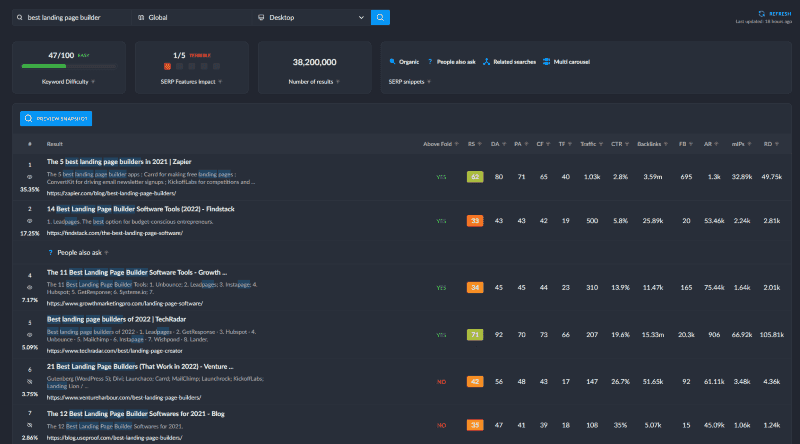

Research keyword demand using tools like Rank Tracker to identify high-traffic finance terms and questions to strategically optimize your content around.

You can write SEO-optimized intros using the SPEAR Framework pioneered by Jamie I.F., a well-known affiliate marketer and the Head of Marketing at Lasso.

4. Connect Through Relatable Examples

Personal finance content that incorporates relatable anecdotes and examples helps readers see themselves reflected in the advice. This builds engagement and trust.

Share a brief story about feeling overwhelmed by student loan debt after college. Many readers will connect with this experience and relate better to the guidance that follows.

When explaining financial concepts like opportunity cost, make it tangible. For example, compare buying a daily $5 coffee versus saving that $5 a day to illustrate how small spending choices add up.

When you’re writing guides to starting a business, saving money, or anything else, make sure your examples are based on people’s likely interests. You can also be more specific, for example, rather than a general “how to make money online” guide, you can be more specific with guides on:

- How to make money 3D printing

- How to make money selling DIY wood crafts on Etsy

- How to make money with affiliate marketing

- How to make money with drone photography

Use analogies and comparisons to bring dry topics to life. For investing advice, liken buying 10 shares of a stock to the amount of the average monthly grocery budget. This helps demonstrate the concept in a more tangible way.

Drawing parallels between new concepts and readers’ existing experiences and habits helps bridge connections. Leverage the power of relatability to write finance content that resonates.

5. Be Empathetic

Readers are more receptive to personal finance content with an empathetic, inclusive tone that builds trust. Avoid lecturing or talking down. Instead, write as if you're an understanding friend.

Use collective pronouns like “we” and_ “us” _when sharing advice. This creates a supportive tone, with the writer right there with the reader working towards financial goals.

If discussing debt, acknowledge many people face debt through no fault of their own. Provide perspective by noting even small consistent money-saving efforts can make a big difference over time.

Many people really struggle with debt, and it’s very stressful for them. Many people have spending issues – and while it may sound ridiculous to spend $500 on a luxury cologne while living paycheck to paycheck, it may not be as easy for them.

Meeting readers where they are with compassion builds engagement. Lean into difficult money topics with care. Celebrate small wins, provide encouragement, and emphasize that financial literacy is an ongoing journey for us all.

An empathetic voice reassures readers and positions the writer as a trusted guide, not just an expert. Financial vulnerability should be handled with compassion.

6. Increase Engagement Through Interaction

Encouraging reader participation helps content stand out while providing additional value. There are easy ways to make finance content more interactive.

End articles with open-ended questions inviting readers to share experiences, like “What budgeting strategies have worked for you?” This sparks conversation.

Embed quick one-click polls asking readers to vote on financial priorities, habits, or perspectives. Polls grab attention while yielding useful data.

Prompt readers to contribute their own tips or advice in the comments section. People love sharing their knowledge. Facilitate financial discussions.

Post content to forums, Facebook Groups, Reddit, and LinkedIn to widen the conversation. Reply to feedback and questions to further engage.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

The more you involve readers, the more they will continue returning to your content for the sense of community. An interactive finance site keeps readers learning and sharing.

FAQs

What are some of the most popular personal finance topics to write about?

Some of the most in-demand personal finance topics include budgeting, debt repayment, credit management, retirement planning, investing, taxes, paying for college, and reducing expenses. High-traffic keywords show what people are most interested in learning.

How can I demonstrate expertise on personal finance topics I'm less familiar with?

Conduct extensive research by reading financial books/blogs, taking relevant courses, or interviewing experts. Talk to financial planners or accountants to better understand the basics. Always fact-check statistics and information before publishing.

What is the best format for personal finance content?

List posts, step-by-step guides, and long-form articles tend to work well for delivering personal finance tips and education. Use headings and spacious formatting to make scannability easy.

How do I write personal finance content in an empathetic, non-judgemental way?

Acknowledge financial struggles many face, use inclusive language like "we", avoid lecturing tones, provide encouragement and perspective, and meet readers where they are. Focus on practical solutions.

What are some great sites to guest post personal finance content?

Well-known sites like Up The Gains, Listen Money Matters, Wallet Hacks, Wise Bread, Money Under 30, Credit Karma, and NerdWallet may accept a contributor post if it is excellent and relevant.

Final Thoughts

Creating quality personal finance content with high value should be the top focus for writers in this space.

As covered in this article, conduct thorough research, provide actionable money tips, optimize for SEO, employ an empathetic voice, and encourage engagement with readers.

Keep the focus on delivering practical, trustworthy advice readers can actually apply to improve their financial situations. Well-researched, empathetic, optimized content drives organic traffic while building reader trust and loyalty.

Now that you know how to craft great finance content, it’s time to put these tips into practice! Start brainstorming your next article idea and incorporate the strategies from this guide. Your helpful, optimized content will empower readers and attract search traffic.